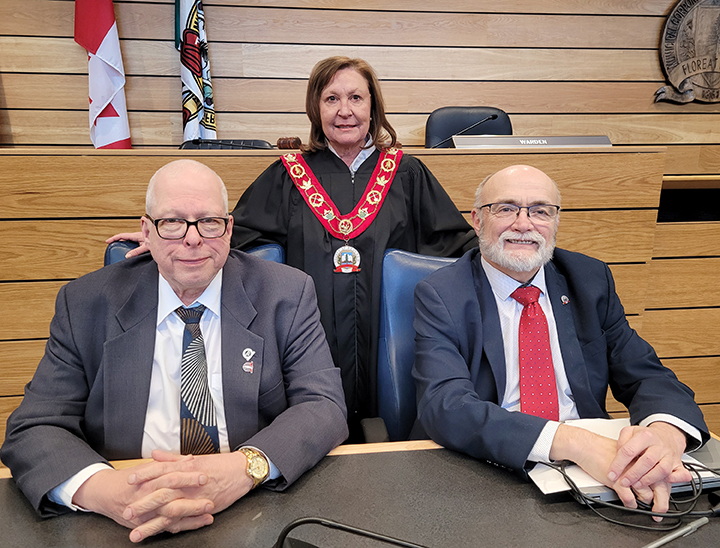

County of Renfrew Council has approved the 2026 budget during the Budget Workshop on January 29. At the conclusion of the meeting Warden Jennifer Murphy thanked Corporate Services Vice-Chair Councillor David Mayville (left) and Chair Councillor Peter Emon for leading the discussions during the workshop.

RELEASE DATE:

January 30, 2026

Budget balances affordability concerns with essential service delivery and long-term responsibility

County of Renfrew Council has approved the 2026 County Budget, a plan that protects essential services, responds to changing community needs, and continues to move key County priorities forward, while recognizing the very real affordability pressures being felt by residents across the Ottawa Valley.

The 2026 budget was developed in an environment of rising costs and growing service demands being experienced by municipalities across Ontario. Council worked through the process with a focus on maintaining services residents rely on every day, while making responsible decisions that support the long-term sustainability of the County.

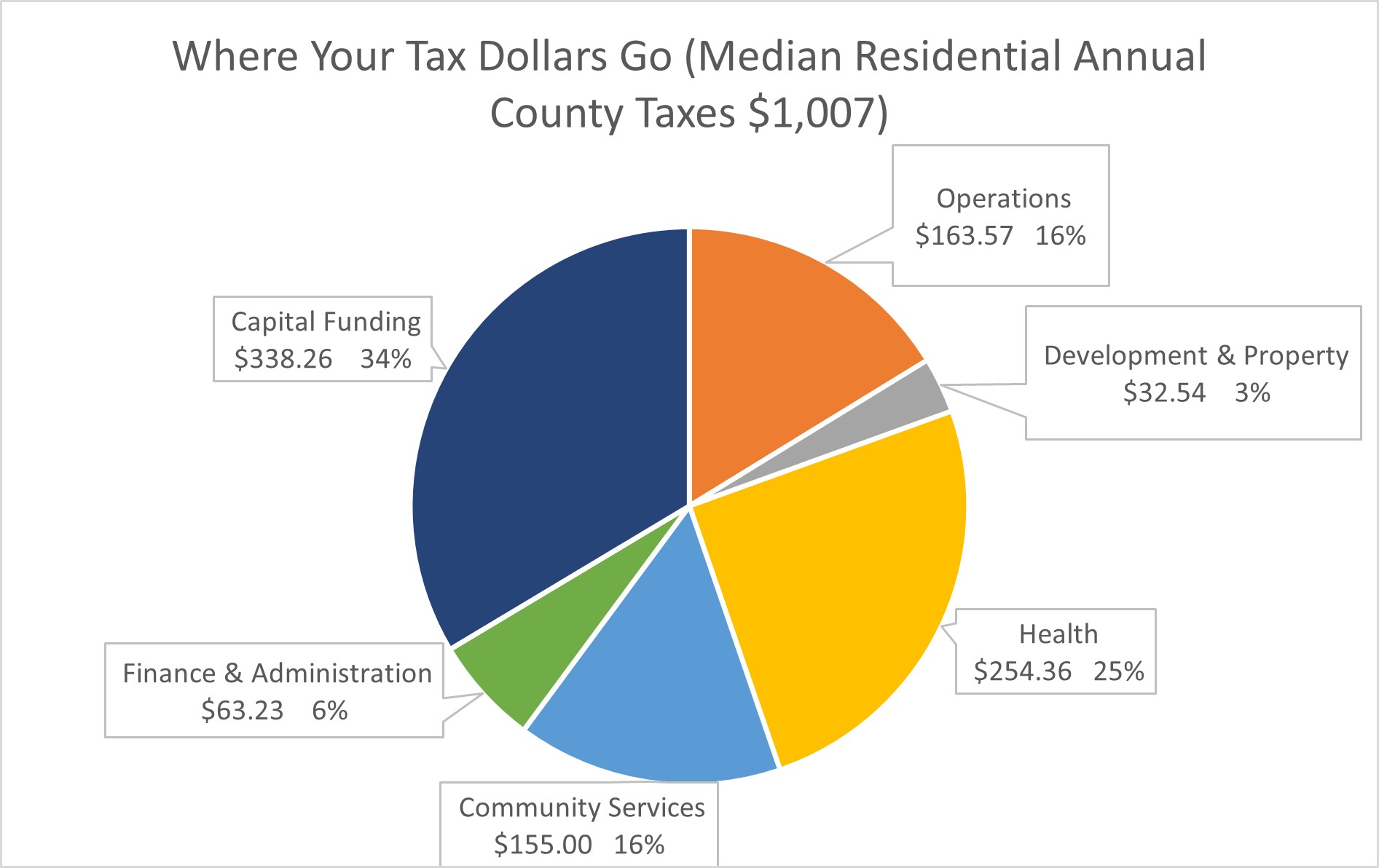

For 2026, the County’s levy reflects weighted assessment growth of 1.23% and a levy increase of 6.68%. This corresponds to a $28.71 rise in residential property taxes for every $100,000 in assessed value. Given that Renfrew County's median residential property value is currently $217,000, the average homeowner would spend $1,007 in 2026 for the County portion of their taxes.

Warden Jennifer Murphy said the 2026 budget required difficult discussions and disciplined decision making

“This has been one of the most challenging budgets our County has ever faced. Balancing significant financial pressures with our responsibility to maintain the essential services our residents rely on required difficult conversations and thoughtful decision making,” she said. “I want to extend my sincere thanks to Council for their perseverance and leadership throughout this process, and to our dedicated staff for their expertise, hard work, and unwavering commitment to serving our community. Together, we have charted a responsible path forward in a demanding year.”

Chair of the Corporate Services Committee, Councillor Peter Emon, emphasized the balance Council was working to achieve.

“This year’s budget was especially challenging as we worked to strike a balance between addressing our community’s concerns about affordability and ensuring residents continue to have equitable access to essential services” he said. “At the same time, we must plan for services that need to be updated, retooled, or newly developed as community needs evolve and best practices emerge across the many sectors we support.”

The County’s approved budget supports the delivery of major County responsibilities, including Long-Term Care, Paramedic Service, Public Works, Housing and Homelessness Programs, Ontario Works and employment supports, Child Care and EarlyON Programs, Planning, Economic Development, and Corporate Services that support front-line operations.

The budget also reflects the County’s commitment to long-term financial planning, including continued focus on infrastructure and facility needs, and the ongoing reality of asset renewal pressures affecting communities across Ontario.

FOR MORE INFORMATION CONTACT:

Craig Kelley Chief Administrative Officer 613-735-7288

Daniel Burke Treasurer 613-735-7288

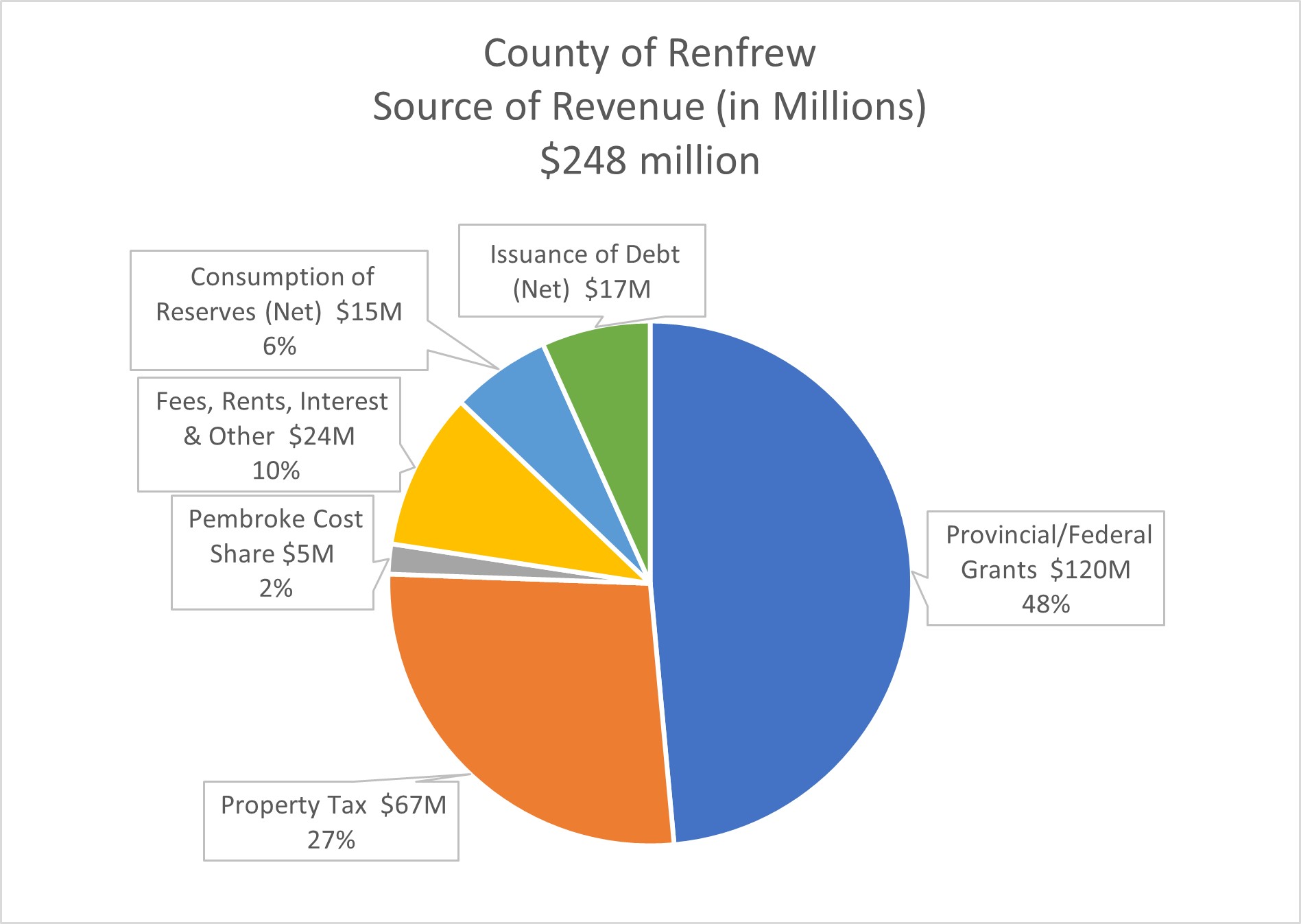

Property taxes account for approximately one-quarter of the County revenues, with other sources of revenue shown in the chart below:

This graphic shows how tax dollars are distributed by department: